Preferred Stockholders Hold a Claim on Assets That

I Preferred stockholders hold a claim on assets that has priority over the claims of common stockholders but after that of bondholders. D both common stockholders and bondholders.

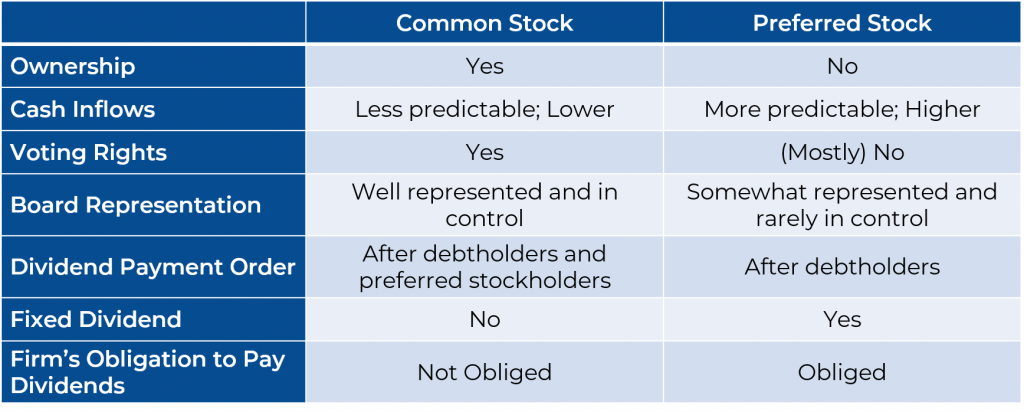

Common Stock Vs Preferred Stock 365 Financial Analyst

Has priority over the claims of neither common stockholders nor bondholders.

. Preferred stock shareholders will have claim to assets over common stock shareholders in the case of company liquidation. In the event a company liquidates holders of common stock have a right to claim a portion of remaining assets only after preferred stockholders have been paid out. Has priority over the claims of.

Basics of Preferred Stock. C common stockholders but after that of bondholders. Preferred stock also has first right to dividends.

I Preferred stockholders hold a claim on assets that has priority over the claims of common stockholders but after that of bondholders. The shares are more senior than common stock but are more junior relative to debt such as bonds. Preferred shares are equity but in many ways they are hybrid.

C neither common stockholders nor bondholders. The preferred shareholder is given preference for the distribution of dividends which is higher than the common stock. B Have a subordinated claim to dividends.

While preferred shareholders do not typically have a right to vote in the company they do hold the benefit of. Has priority over the claims of both common stockholders and bondholders. Preferred stockholders hold a claim on assets that has priority over the claims of A both common stockholders and bondholders.

B neither common stockholders nor bondholders. 3 I Preferred stockholders hold a claim on assets that has priority over the claims of common stockholders but after that of bondholders. The primary benefit of owning preferred stock is that you have a greater claim to company assets than common stockholders.

Preferred stockholders hold a claim on assets that has priority over the claims of common stockholders but after that of bondholders. Preferred Shares Preferred shares preferred stock preference shares are the class of stock ownership in a corporation that has a priority claim on the companys assets over common stock shares. II Firms issue preferred stock in far greater amounts than common stock.

The right to share in the companys profitability income and assets eg in the form of dividends A degree of control. Preferred holders always get dividends before common holders in case a company enters bankruptcy and the preferred holders are always paid first. Because of the risk of being at the back of the line to receive dividends or asset payments new investors feel financially safer purchasing preferred stock but must understand that they will not be entitled.

C Possess an ownership interest in the firm. D bondholders but after that of common stockholders. ODN Holding Corp the Court refused to dismiss claims that a private equity fund and the directors of one of its portfolio companies breached their fiduciary duties to common stockholders by selling certain of the companys business lines and assets in order to fund a mandatory redemption of preferred stock.

D Normally have no vote on corporate issues. 17 Preferred stockholders hold a claim on assets that has priority over the claims of hold a claim on assets able to receive money Group of answer choices I both common stockholders and bondholders neither common stockholders nor bondholders common stockholders but after that of bondholders T bondholders but after that of common. II Firms issue preferred stock in far greater amounts than common stock.

II Firms issue preferred stock in far greater amounts than common stock. Preferred stock is an equity security that has the properties of both an equity and debt instrument and is higher ranking than common stock. I Preferred stockholders hold a claim on assets that has priority over the claims of common stockholders.

Preferred shareholders definition can be stated as the owners of stock who have priority on a companys assets. A Play a primary role in the financing of the firm. With a 2x liquidation preference.

I is true II false. Preferred shares preferred stock preference shares are the class of stock ownership in a corporation that has a priority claim on the companys assets over common stock shares. Preferred stockholders hold a claim on assets that.

It is paid as per the discretion of the companys directors. The cost of each component of a firms capital structure multiplied by its weight in. 59 Preferred stockholders hold a claim on assets that has priority over the claims of A bondholders but after that of common stockholders.

Preferred stock is a type of ownership that receives greater demand on a companys profits and assets than common stock. The case while decided on a. I Preferred stockholders hold a claim on assets that has priority over the claims of common stockholders but after that of bondholders.

Preferred shareholders have a prior claim on a companys assets if it is liquidated though they remain subordinate to bondholders. II Firms issue preferred stock in far greater amounts than common stock. B common stockholders but after that of bondholders.

Preferred stockholders hold claim on assets that have priority over the claims from MGMT 4390 at Sam Houston State University. The shares are more senior than common stock but are more junior relative to debt such as bonds. The most important rights that all common shareholders possess include.

Common Shares Vs Preferred Shares Comparison Of Equity Types

What S The Difference Between Preferred And Common Stock Quora

0 Response to "Preferred Stockholders Hold a Claim on Assets That"

Post a Comment